The SSN applied sanctions and precautionary measures during the first semester of 2017, in relation to breaches of the investment regime, late filings and irregular exercise of the activity for which the authorization to operate was granted.

The Argentine Superintendence of Insurance (“SSN”, after its acronym in Spanish) applied different sanctions and precautionary measures during the first semester of 2017.

The behaviors on which the sanctions imposed are based relate to breaches of the investment regime, the late filing of financial statements or information about reinsurance contracts and the irregular or abnormal exercise of the activity for which the authorization to operate was granted.

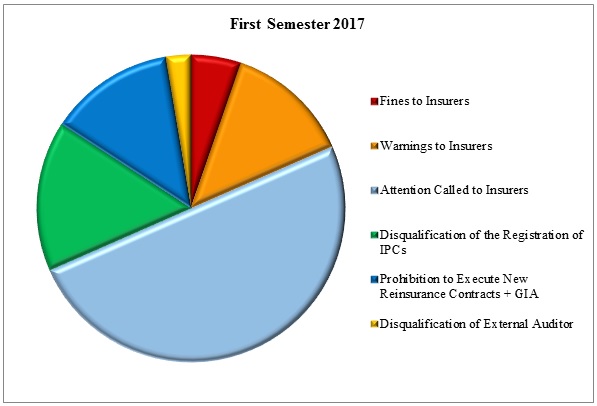

The measures adopted include sanctions of fines and warnings to insurance companies; the prohibition to execute new reinsurance contracts and to freely access their investments, with general inhibition of assets (“GIA”) (see “Restructuring Plan for Local Reinsurers” published in Insurance News No. 4 of June 12, 2017); as well as the disabling of the registration as insurance producer consultant (“IPC”) and as external auditor.

We then describe the different behaviors that caused the sanctions or precautionary measures during the first semester of 2017 by applying the Law on Insurance No. 17,418 (“Insurance Law”), the Law on Insurance Entities and their Control No. 20,091 (“Law on Insurance Entities”), the General Regulation of the Insurance Activity approved by General Resolution SSN No. 38,708 (“RGAA”, after its acronym in Spanish), the Law on the Insurance Producers Consultants Regime No. 22,400 (“Law on IPCs”), provisions of the National Civil and Commercial Code (“NCCC”), among other specific regulations outlined below.

The sanctions and measures detailed below are shown in the following diagram, representing the proportions of the different sanctions and measures provided by the SSN.

Fines to insurance companies under the terms of article 58(c) of the Law on Insurance Entities

|

Resolution SSN |

Date |

Alleged infringement / conduct that gave rise to the measure |

Applied standards |

Observation |

||

|---|---|---|---|---|---|---|

|

1 |

No. 40447 |

May 15, 2017 |

Manifest irregular and abnormal exercise of the insurance business, contrary to the rules of the activity for which it was authorized to operate |

Insurance Law, Law on Insurance Entities, art. 321 of the NCCC |

Fine of AR$125,757 |

These resolutions can be appealed in accordance with article 83 of the Law on Insurance Entities |

|

2 |

No. 40545 |

June 15, 2017 |

Late filing of financial statements |

Law on Insurance Entities; Sections 39.8.1 and 39.8.2 of the RGAA; arts. 886 and 1725 NCCC |

Fine of AR$349,612.72 |

|

Warning to insurers under the terms of article 58(b) of the Law on Insurance Entities

|

Resolution SSN |

Date |

Alleged infringement |

Applied standards |

Observation |

|

|---|---|---|---|---|---|

|

1 |

No. 40544 |

June 15, 2017 |

Late filing of financial statements |

Law on Insurance Entities; Sections 39.8.1 and 39.8.2 of the RGAA; arts. 886 and 1725 NCCC |

These resolutions can be appealed in accordance with article 83 of the Law on Insurance Entities |

|

2 |

No. 40547 |

June 15, 2017 |

|||

|

3 |

No. 40550 |

June 15, 2017 |

|||

|

4 |

No. 40551 |

June 15, 2017 |

|||

|

5 |

No. 40634 |

July 25, 2017 |

Late filing of information on automatic reinsurance contracts |

Law on Insurance Entities; SSN Resolution No. 37,871 dated October 23, 2013; arts. 886 and 1725 NCCC |

|

Attention called to insurance companies under the terms of article 58(a) of the Law on Insurance Entities

|

Resolution SSN |

Date |

Alleged infringement |

Applied standards |

Observation |

|

|---|---|---|---|---|---|

|

1 |

No. 40498 |

May 30, 2017 |

Late filing of financial statements |

Law on Insurance Entities; Sections 39.8.1 and 39.8.2 of the RGAA; arts. 886 and 1725 NCCC |

These resolutions can be appealed in accordance with article 83 of the Law on Insurance Entities |

|

2 |

No. 40505 |

May 31, 2017 |

|||

|

3 |

No. 40506 |

May 31, 2017 |

|||

|

4 |

No. 40638 |

July 25, 2017 |

|||

|

5 |

No. 40444 |

May 15, 2017 |

Inadequacy of investments by keeping funds in current accounts affected to guarantee trusts |

Law on Insurance Entities; Resolution SSN No. 39,355 and art. 1725 of the NCCC |

|

|

6 |

No. 40504 |

May 31, 2017 |

Inadequacy of investments in eligible assets for the determination of the status of coverage |

Law on Insurance Entities; Section 35.8.1.(l) of the RGAA; article 1725 NCCC |

|

|

7 |

No. 40546 |

June 15, 2017 |

|||

|

8 |

No. 40548 |

June 15, 2017 |

|||

|

9 |

No. 40549 |

June 15, 2017 |

|||

|

10 |

No. 40552 |

June 15, 2017 |

|||

|

11 |

No. 40553 |

June 15, 2017 |

|||

|

12 |

No. 40630 |

July 25, 2017 |

|||

|

13 |

No. 40632 |

July 25, 2017 |

|||

|

14 |

No. 40633 |

July 25, 2017 |

|||

|

15 |

No. 40636 |

July 25, 2017 |

|||

|

16 |

No. 40639 |

July 25, 2017 |

|||

|

17 |

No. 40640 |

July 25, 2017 |

|||

|

18 |

No. 40641 |

July 25, 2017 |

|||

|

19 |

No. 40635 |

July 25, 2017 |

Law on Insurance Entities; Section 35.8.1.(l) of the RGAA; article 1725 NCCC; Law No. 19,549 |

||

Disabling registration of IPCs

|

Resolution SSN |

Date |

Alleged infringement/Conduct that gave rise to the measure |

Applied standards |

Observation |

||

|---|---|---|---|---|---|---|

|

1 |

No. 40557 |

June 19, 2017 |

Absolute inability to register in the Registry of IPCs of those who operate as insurance producer consultants during the validity of the Law on IPCs without being registered and those who are excluded from registration for breaches of same |

Insurance Law, Law on Insurance Entities and Law on IPCs and its regulation |

Disqualification for 2 years under the terms of article 59(d) of the Law on Insurance Entities |

This resolution can be appealed in accordance with article 83 of the Law on Insurance Entities |

|

2 |

No. 40568 |

June 24, 2017 |

Did not make an appearance on the date agreed upon for the inspection, despite being duly notified at the commercial address reported to the registry |

Law on Insurance Entities, Law on IPCs and article 141 of the National Civil and Commercial Procedural Code ("NCCPC”) |

Duty to appear and provide the mandatory registry books in legal form |

|

|

3 |

No. 40501 |

May 31, 2017 |

||||

|

4 |

No. 40502 |

May 31, 2017 |

||||

|

5 |

No. 40509 |

May 31, 2017 |

||||

|

6 |

No. 40637 |

July 25, 2017 |

||||

Prohibition to local reinsurers to execute new contracts of reinsurance and prohibition of free access to their investments, with GIA, until the end of the Restructuring Plan

|

Resolution SSN |

Date |

Conduct that gave rise to the measure |

Applied standards |

Observation |

||

|---|---|---|---|---|---|---|

|

1 |

No. 40558 |

June 19, 2017 |

Non-adhering to the regime on Gradual Adequacy of Minimum Capital nor evidencing the minimum capital required. Adopting a Restructuring Plan. Decrease of the economic or financial ability, or manifest disproportion between this and the retained risks or deficit in coverage of the commitments made with the insured |

Law on Insurance Entities; SSN Resolution No. 40,422; Sections 30.1.1.1.a, 30.1.2 and 30.7.2 of the RGAA and article 198 of the NCCPC |

Deficit of AR$289,627,320 at March 31, 2017 |

These resolutions can be appealed in accordance with article 83 of the Law on Insurance Entities |

|

2 |

No. 40559 |

June 19, 2017 |

Deficit of AR$297,389,713 at March 31, 2017 |

|||

|

3 |

No. 40560 |

June 19, 2017 |

Deficit of AR$303.952.054 at March 31, 2017 |

|||

|

4 |

No. 40561 |

June 19, 2017 |

Deficit of AR$293,004,032 at March 31, 2017 |

|||

|

5 |

No. 40562 |

June 19, 2017 |

Deficit of AR$314,868,839 at March 31, 2017 |

|||

Disqualification of external auditor in accordance with article 59(d) of the Law on Insurance Entities

|

Resolution SSN |

Date |

Alleged infringement |

Applied standards |

Observation |

||

|---|---|---|---|---|---|---|

|

1 |

No. 40449 |

May 15, 2017 |

Professional misconduct of external auditor enrolled in the register of SSN Auditors |

Law on Insurance Entities and regulations, Section 39.13 of the RGAA |

Disqualification for 5 years. |

This resolution can be appealed in accordance with article 83 of the Law on Insurance Entities |

The revocation of authorization to operate in certain lines was not included here, when such deregistration was requested by the insurers themselves. Nor have we clarified in which of the cases described the measures adopted might be lifted, re-qualifying the IPCs, nor in which cases the resolutions detailed may be appealed.

This insight is a brief comment on legal news in Argentina; it does not purport to be an exhaustive analysis or to provide legal advice.