ARTICLE

Expiration Date for the 2014 Annual Fee of the Public Registry of Commerce of the City of Buenos Aires

Through Resolution No. 1642/2014, the Ministry of Justice and Human Rights set October 14, 2014 as the expiration date for the payment of the Annual Fee by corporations.

September 30, 2014

On September 15, 2014, the Ministry of Justice and Human Rights issued Resolution No. 1642/2014 (the “Resolution”), that was published in the Official Gazette on September 18, 2014 (Official Gazette No. 32,971).

The objective of the Resolution is to set October 14, 2014 as the date of expiration for the payment of the annual fee established by Section 4 of the Administrative Decision No. 46/2001.

Moreover, Section 2 of the Resolution states that if the deadline expires, a fine equivalent to the amount resulting from the application of one and a half times the monthly rate of interest applied by Banco de la Nación Argentina for discounting bills on commercial documents will be implemented on the omitted amounts (Section 7 of the Administrative Decision No. 46/2001).

The annual fee is based on Section 4 of the Administrative Decision No. 46/01, which in turn is based on Organic Law of the Public Registry of Commerce of the City of Buenos Aires No. 22,315 and its Regulatory Decree No. 1493/1982.

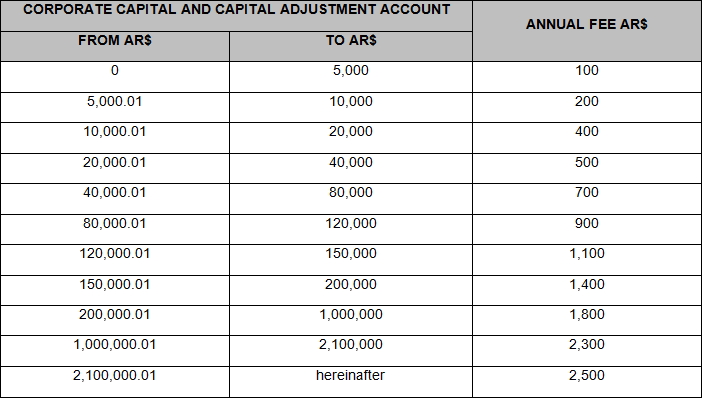

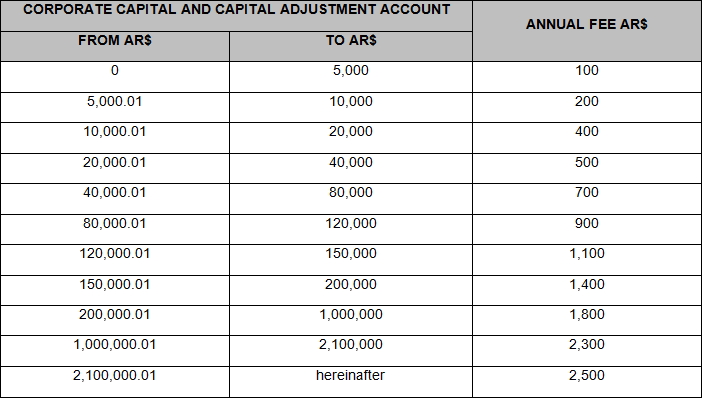

According to Section 4 of the Administrative Decision No. 46/2001, corporations must pay an annual fee for services provided in carrying out its tasks and authority to the Public Registry of Commerce. To calculate the annual fee, Administrative Decision No. 55/2000 sets a range of values to pay, which is determined by the sum of the corporate capital and the capital adjustment account arising from the financial statements of the corporations.

For the 2014 annual fee, scales and values from 2013 are maintained, as shown below:

In order to calculate the annual fee for 2014, the financial statements ended between September 1, 2012 and August 31, 2013 shall be taken into account.

It should be emphasized that, if financial statements are not filed on time, the agency will estimate ex officio the sum that should be paid. The amount of such fee shall be twice as much as what the Company should pay according to the scale shown above, and for these purposes the last financial statements filed with in any of the previous two years will be used. Therefore, it is important to be up-to-date with the filing of financial statements before the due date for the payment of the 2014 annual fee.

Nevertheless, in no case may the result of the ex officio estimation practiced exceed the maximum amount stated in the scale (that is, AR$ 2,500).

If, once the ex officio estimation is made, the company files the financial statements, the amount of the fee will be recalculated automatically.

Finally, even though the annual fees are usually sent to the corporate registered address of the company, in the event they are not received in due time, the fee ballot may be obtained from the website one week before the expiration date (which is as from October 7, 2014). In this regard, by means of General Resolution No. 02/2013, the Public Registry of Commerce decided that the only way to generate the annual fee ballot is through their website (http://www.jus.gob.ar/igj).

The fee can be paid at any branch of the Banco de la Nación Argentina located in the City of Buenos Aires or at the cashiers of the Public Registry of Commerce in its head office and in professional associations.

It is important to highlight that companies that paid their incorporation fee in 2014 are exempt from the payment of the annual fee for the year 2014.

Please note that the Public Registry of Commerce of the City of Buenos Aires will not register the ongoing proceedings and the proceedings to be initiated after October 14, 2014 if the company has not duly complied with the payment of the 2014 annual fee.

The objective of the Resolution is to set October 14, 2014 as the date of expiration for the payment of the annual fee established by Section 4 of the Administrative Decision No. 46/2001.

Moreover, Section 2 of the Resolution states that if the deadline expires, a fine equivalent to the amount resulting from the application of one and a half times the monthly rate of interest applied by Banco de la Nación Argentina for discounting bills on commercial documents will be implemented on the omitted amounts (Section 7 of the Administrative Decision No. 46/2001).

The annual fee is based on Section 4 of the Administrative Decision No. 46/01, which in turn is based on Organic Law of the Public Registry of Commerce of the City of Buenos Aires No. 22,315 and its Regulatory Decree No. 1493/1982.

According to Section 4 of the Administrative Decision No. 46/2001, corporations must pay an annual fee for services provided in carrying out its tasks and authority to the Public Registry of Commerce. To calculate the annual fee, Administrative Decision No. 55/2000 sets a range of values to pay, which is determined by the sum of the corporate capital and the capital adjustment account arising from the financial statements of the corporations.

For the 2014 annual fee, scales and values from 2013 are maintained, as shown below:

In order to calculate the annual fee for 2014, the financial statements ended between September 1, 2012 and August 31, 2013 shall be taken into account.

It should be emphasized that, if financial statements are not filed on time, the agency will estimate ex officio the sum that should be paid. The amount of such fee shall be twice as much as what the Company should pay according to the scale shown above, and for these purposes the last financial statements filed with in any of the previous two years will be used. Therefore, it is important to be up-to-date with the filing of financial statements before the due date for the payment of the 2014 annual fee.

Nevertheless, in no case may the result of the ex officio estimation practiced exceed the maximum amount stated in the scale (that is, AR$ 2,500).

If, once the ex officio estimation is made, the company files the financial statements, the amount of the fee will be recalculated automatically.

Finally, even though the annual fees are usually sent to the corporate registered address of the company, in the event they are not received in due time, the fee ballot may be obtained from the website one week before the expiration date (which is as from October 7, 2014). In this regard, by means of General Resolution No. 02/2013, the Public Registry of Commerce decided that the only way to generate the annual fee ballot is through their website (http://www.jus.gob.ar/igj).

The fee can be paid at any branch of the Banco de la Nación Argentina located in the City of Buenos Aires or at the cashiers of the Public Registry of Commerce in its head office and in professional associations.

It is important to highlight that companies that paid their incorporation fee in 2014 are exempt from the payment of the annual fee for the year 2014.

Please note that the Public Registry of Commerce of the City of Buenos Aires will not register the ongoing proceedings and the proceedings to be initiated after October 14, 2014 if the company has not duly complied with the payment of the 2014 annual fee.

This insight is a brief comment on legal news in Argentina; it does not purport to be an exhaustive analysis or to provide legal advice.