Oil & Gas: Launch of International Public Offshore Bid No. 1 to Grant Hydrocarbons Exploratory Permits

The Argentine Secretariat of Energy published the Bidding Terms and conditions of International Public Bid Round No. 1 to grant offshore exploratory permits in the Argentine continental platform.

On November 6, 2018, Resolution No. 65/2018 (“Resolution 65”) enacted by the Secretariat of Energy (the “SE”) was published in the Official Gazette by means of which the SE (i) calls for International Public Offshore Bid No.1 and (ii) approves the Bidding Terms and Conditions (the “Bidding Terms”).

Resolution 65 issued within the framework of Decree No. 872/2018 (the “Decree 872”) enacted by the Argentine Executive (the “PEN”). Decree 872 defined the areas to be offered in this Round, the formula to define the applicable percentage of royalties and the conditions under which disputes can be brought before an arbitration court (for more information on Decree 872, please see Marval News No. 188 dated November 2, 2018).

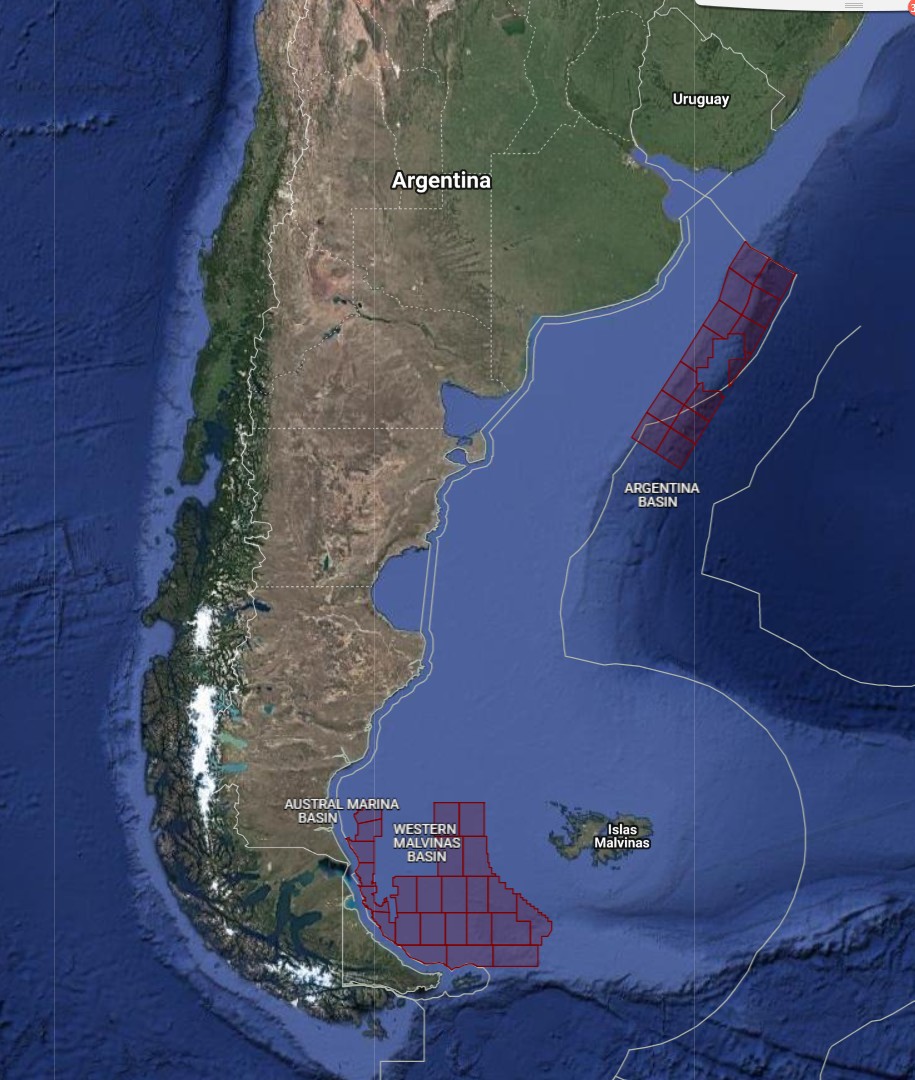

The 38 areas comprise:

- 14 areas of the Northern Argentina Basin (7 deep water blocks – WD 200 to 1,300m – from 6,000 to 9,000 km2, and 7 ultra-deep water blocks – WD 1,200 to 4,000m – from 3,000 to 9,000 km2);

- 6 areas of the Austral Sea Basin (shallow water – WD below 100m) from 2,000 to 2,700 km2; and

- 18 areas of the Western Malvinas Basin (deep water – WD 100 to 700m) from 3,600 to 6,300 km2.

We describe below the main features of the Bidding Terms:

1. Schedule

Until February 14, 2019, interested parties can (i) file the documents required by the Bidding Terms to be included in the list of prequalified bidders, (ii) acquire access codes to the Virtual Database, and (iii) submit their queries to the SE regarding the Bid Terms. Queries and clarifications regarding the Bidding Terms will be published in the SE’s website.

On March 14, 2019 is the opening date for offers by the bidders. The list of offers with respect to each block and their bidders will be published later in the SE’s special website designed for this Round: https://costaafuera.energia.gob.ar/es.index.html

On April 15, 2019, the resolution awarding the blocks will be published.

On July 15, 2019, resolutions granting exploration permits will be published.

On July 30, 2019, final exploratory titles will be granted.

2. Bidders’ pre-qualification

Bidders of the Round must pre-qualify in the following categories: Operator A, B or C, or Non Operator A, B or C. To be included in the list of pre-qualified bidders by the SE, interested parties must submit certain legal documents as well as evidence of technical and financial conditions to participate as a partner and more restrictively to act as an operator. The SE will publish a list of pre-qualified bidders to participate in the Round. If the bidder is a consortium, each member should be included in the list.

Bidders must also purchase the access codes to the Digital Database.

2.1. Operator types

- Operator/Non Operator = A / for all blocks

- Operator/Non Operator = B / for deep and shallow waters

- Operator/Non Operator = C / only for shallow waters

Companies listed in “The Energy Intelligence Top 100 Ranking the World’s Top Oil Companies” and/or “Top 50: Global NOC & IOC Rankings” will automatically qualify as Operator/Non Operator A.

2.2. Financial requirements

Financial requirements to qualify as operator may be complied with by reaching parameters measured either by (i) average capital investments 2015/16/17 or (ii) latest balance sheet net worth. In case of non-operators, requirements are reduced to 50%.

|

Operator |

Avg. Capital Investments 2015/16/17 in USD MM |

Net Equity in USD MM last balance |

|

A |

700 |

250 |

|

B |

300 |

100 |

|

C |

100 |

30 |

2.3. Technical requirements

|

Operator A |

Operator B |

Operator C |

|

Production > 20000 boe/d (barrels of oil equivalent per day) average 2015/16/17. This requirement may be achieved demonstrating the operation of at least 3 exploration wells in water of more than 500 m. depth in the last 15 years |

Production > 10000 boe/d (barrels of oil equivalent per day) average 2015/16/17. This requirement may be achieved demonstrating the operation of at least 3 exploration wells in water of more than 100 m. depth in the last 15 years |

Production > 5000 boe/d (barrels of oil equivalent per day) average 2015/16/17. This requirement may be achieved demonstrating the operation of at least 3 offshore exploration wells in the last 15 years. |

|

Operated at least in one block in the last 15 years in waters deeper than 500 m. depth (Exploration or Exploitation) |

Operated at least in one block in the last 15 years in waters deeper than 100 m. depth (Exploration or Exploitation) |

Operated at least in one block in the last 15 years in offshore (Exploration or Exploitation) |

2.4. Technical and/or economic-financial guarantee

In that the event the bidder does not comply with the pre-qualification requirements mentioned in Section 2.2 and 2.3 above on its own behalf, its parent company must grant full technical and/or economic-financial guarantee, as applicable. The parent company granting the guarantee must assume joint and several liability in favor of the SE with respect to all aspects of the Round, together with the bidder/subsidiary.

2.5. Minimum Working Interest

Operator must hold an interest of at least 30% in the permit/concession while partners (non-operators) must hold a minimum interest of 5%. Parties undertake the obligation to reach a unitization agreement.

3. Offers

3.1. Presentation of offers and awarding criteria. Entrance bonus

Presentation and opening of offers will be performed on March 14, 2019.

Offers will consist of committed Working Units (“WU”) for the first exploration period.

Each block contains: (i) Minimum Working Units (equivalent to a 3x3 km of 2D in 100% of the block) and (ii) Basic Working Units (equivalent to 20% to 40% of 3D of the surface of the block).

Each block will be awarded to the best offer. The best offer will be decided by the following formula:

BID (USD) = WU x 5000 (USD/WU) + Bonus (*)

*Bonus is accepted only if WU is higher than Basic Working Units.

Bonus will be paid 50% upfront, within 10 business days as from the exploratory permit becoming effective, and the remaining 50% at the end of the third year. The latter is exchangeable for WU performed in the first 3 years in excess of the offered WUs.

If there is a tie between two or more offers in USD, the winner will be the company that, having submitted the tying offer, then submits the best offer in the re-bidding that will be called by the SE, under the same conditions/formula as the first bidding.

3.2. Bid Maintenance Bond/Guarantee

Together with the offer, bidders must submit a guarantee of USD 100,000 for 120 days as of the opening date and for each block offered. If the offeror is awarded a block, the term of the bid guarantee must be automatically extended until the performance bond/guarantee described in Section 4.3 below is submitted.

The guarantee must be set up in any of the following ways: a stand-by letter of credit, a bank guarantee or a private surety bond.

3.2. Investment vehicle

Foreign companies will be able to bid, with a commitment to start the registration process of a local branch or a local subsidiary if one of the blocks is pre-awarded to them. Final registration will be a requirement to grant the final permit exploration title.

4. Exploration Permit

Exploration periods and surface rights are consistent with the existing regulatory framework:

- Two periods of 4 years, plus an extension of 5 years for all blocks except for Austral basin blocks (shallow waters) for which two periods, first of 4 years and second of 3 years, and an extension of 4 additional years is provided.

- No relinquishment after the first period and only 50% relinquishment after the second period.

- Permit holders must drill at least one well in the second period and an additional well in the extension period.

4.1. Working Program Flexibility

Changes to the working program may be carried out with prior approval by the regulatory authority. The companies will have the possibility to make changes to the program without the regulatory authority’s approval for up to 40% of the WUs committed, only when that 40% is fulfilled either with 2D seismic, 3D seismic, or drilling of a well (including casing, coring, testing). The permit holder will have to comply with the working program proposed in its bid and fulfill 100% of the number of WUs offered.

In line with Section 20 of the Hydrocarbons Law No. 17,319 (the “Hydrocarbons Law”), WUs performed in excess of the amount committed in one period may be carried forward to the following period. The obligation to drill a well cannot be compensated with other exploratory activities.

Committed Working Units not fulfilled in one given period must be paid in cash. Otherwise, the enforcement authority will execute the guarantee granted by the company (see Section 4.3 below).

4.2. Obligation to drill a well

Permit holders must drill a well in the second period and an additional well in the extension period.

Mandatory well of the second period may be postponed to the extension period if the SE considers that there is a significant and solid technical or economic justification. In such case the well will have to be drilled within the first 2 years of the extension period in addition to the mandatory well of the extension period.

4.3. Performance bond/guarantee

Resolution 65 establishes that within 30 days as of the effective date of the Permit, the permit holder or its operator (on behalf of the permit holder) must obtain a performance bond to the satisfaction of the SE in an amount equal to: (i) 100% of Minimum WU + (ii) 25% of Additional to Minimum WU + (iii) 50% of the Deferred Bonus payment. Calculation of the performance bond/guarantee may be adjusted on a yearly basis upon fulfillment of the WU.

For the second period and extension period (until obligation to drill the well is fulfilled), permit holders must grant a guarantee for:

- USD 10 million (for shallow blocks)

- USD 17 million (for deep water blocks)

- USD 22 million (for ultra-deep water blocks)

None of the abovementioned guarantees will limit the liability of the permit holder and its parent company, if applicable, with respect to their obligations under the bid, the offer, the permit, the Bidding Terms and applicable law.

5. Exploitation Concession

Permit holders who discover hydrocarbons in the block will have the right to obtain an exploitation concession over such block. Exploitation concessions will be granted for 30 years plus 10 years of successive extensions, which must be requested at least 1 year before the expiration of the concession.

5.1. Royalties and Canon

The Hydrocarbons Law establishes a royalty of 12% over the production’s proceeds, which may be reduced to 5% for offshore concessions. As mentioned above, Decree 872 provides the formula that must be applied annually to determine the percentage of royalties that must be paid by those who are granted an exploitation concession within this international public bid.

Resolution 65 defined the mechanism to calculate royalties between a minimum of 5% and the maximum of 12%, as detailed below:

- The royalty rate to be paid by the exploitation concessionaire will be defined by the results of an R factor calculated annually as of December 31, (as defined below in paragraph (b)), where:

- For any R factor less than or equal to 1, the applicable royalty rate will be 5% (R <= 1.1 → Royalties = 5%).

- For any R factor greater than 1.1 and less than 1.8, the applicable royalty rate shall be determined by multiplying the applicable R factor by 10 and then subtracting 6 (R > 1.1 and < 1.8 → Royalties = (R * 10) - 6).

- For all R factors equal to or greater than 1.8, the applicable royalty rate will be 12% (1.8 < R → Royalties = 12%).

- The R factor will be the quotient between (i) the aggregate amount of Production Sales (Sales) less the aggregate amount of Royalties, and (ii) the sum of the aggregate amount of Exploration & Appraisal Investments (E&A), the aggregate amount of D Investments (Investments) and the aggregate amount of Operating Expenses (OPEX).

R factor = ∑ (Sales – Royalties) / ∑ (E&A + Investments + OPEX)

- Resolution 65 defines the scope, inclusions and exclusions of each concept of the formula described above.

As provided by Hydrocarbons Law, producers will pay a canon annually over the surface of the concession area to be calculated by multiplying ARS 4,500 per km2 or fraction.

5.2. Suspension of the Development Plan

The Bidding Terms include a development plan suspension period of up to 5 years as from the granting of the concession, which is renewable for an additional period of up to 5 years if the inconvenient conditions invoked and evidenced by the Concessionaire persist. This will apply for gas prevalent deposits in shallow waters blocks and for oil and gas deposits for deep and ultra-deep waters blocks (provided that suspension is based on lack of infrastructure or economic viability).

When requiring the suspension and at the end of the first 5-year period, companies must make a filing to the regulatory authority explaining the reasons for the suspension and clarifying under which conditions the discovery could be developed. To apply for this suspension the discovery must have been appraised by at least 2 wells in the field.

During the suspension of the development plan the concessionaire should pay the surface fees (canon) and the exploitation concession duration will not be suspended.

5.3. Promotional Regime

The Bidding Terms establish that benefits from Law No. 27,007 and Decree 929/13 (the “Promotional Regime”) will apply to the concessions granted under this Round. The Promotional Regime is available for projects involving direct investments of 250 million USD or more to be made during the first 3 years of the exploitation concession period.

Benefits under this regime can be enjoyed as from the third year since execution of the exploitation project was initiated, and must consist of the right to freely export up to 20% of the production of the project, in the case of shallow water offshore projects (average water depth less than 90 m) and up to 60%, in the case of deep water offshore projects (average water depth greater than 90 m). Exportation of this portion of the hydrocarbon production will be free of export duties (zero rate) and concessionaires will have free disposal of the proceeds in foreign currency from the export of said portion of hydrocarbons production.

The Promotional Regime provides that, in the event that, due to a shortfall of hydrocarbons, exports are restricted to the supply of local demand, concessionaires will be entitled to be paid international prices for the hydrocarbons that could have been exported and were not actually exported. In this event, producers will have a priority right to acquire foreign currency in the Official Exchange Market up to the total amount of the local currency obtained in exchange of the hydrocarbons that were prevented from being exported, including the amounts collected for their sale in the domestic market plus any compensations received under the above mechanism, provided that the execution of the project would have implied the inflow within the Argentina financial system of at least 250 million US Dollars.

5.4. Open access to facilities’ spare capacity

The Bidding Terms and conditions establish that concessionaires undertake to provide open access to the remaining capacity of their facilities (including, without limitation, transport, compression and treatment facilities) at market rates and under transparency and non-discrimination conditions to any concessionaire requiring such access.

6. Requirement to hire local personnel

The Hydrocarbons Law requires that permit holders and concessionaires hire a minimum of 75% of local employees. Resolution 65 provides that such percentage must be complied with as follows: during the exploration phase, companies must present their program to train local people and increase the percentage of local hires on an annual basis. In addition, during the exploitation phase 50% of locals would be required to be hired during the first year of production, increasing 5% every year until a total of 75% is reached in the sixth year.

7. Arbitration Clause

Decree 872 authorizes to include, in the relevant exploration permits and exploitation concessions, provisions regarding the submission to international arbitral courts of a jurisdiction which is a party to the Convention on the Recognition and Enforcement of Foreign Arbitral Awards (New York, 1958) (the “New York Convention”).

According to Resolution 65, upon expiration of a 30 calendar-day term to hold friendly negotiations without an agreement having been reached by the parties in respect of the dispute, any lawsuit of less than, or equal to, 20 million USD must be submitted to the Federal Courts in the City of Buenos Aires. Those claims exceeding the amount of 20 million USD would be brought before an Arbitration Court of 3 Arbitrators appointed one each by each Party, and the third one to be agreed by the parties from among the members of the Permanent Court of Arbitration of The Hague (PCA) panel. If no agreement is reached, the third Arbitrator will be appointed by the President of the Argentine Supreme Court from the same PCA panel within 60 days (pursuant to Section 86 of the Hydrocarbons Law). If the President of the Argentine Supreme Court does not appoint the third arbitrator then the parties may request the PCA Secretary General to appoint the third arbitrator from the PCA panel.

Arbitration will be conducted by agreed rules or otherwise UNCITRAL rules. The arbitration will be based on law and will be resolved according to the laws in force in the Republic of Argentina, in particular, Hydrocarbons Law and related laws, Decree No. 872, Resolution 65 and the Bidding Terms.

The submission of a dispute to arbitration by the permit holder and/or the concessionaire would prevent foreign majority shareholders from claiming the protection of a Bilateral Investment Treaty for the same events or measures. Therefore, to be able to submit a valid arbitration request, the permit holder and/or the concessionaire must submit: (i) the waiver by the foreign controlling or majority shareholders to file claims under a Bilateral Investment Treaty in connection with the events and measures questioned in the dispute submitted to arbitration; and (ii) an indemnity commitment by the permit holder and/or the concessionaire for the claims of foreign minority shareholders under a Bilateral Investment Treaty in connection with the events and measures questioned in the dispute submitted to arbitration.

The seat of arbitration will be Buenos Aires for local companies or, if the holder of the permit or concession is controlled by foreign shareholders, the seat of arbitration will be agreed by the two Parties in a city of a country that is a party to the New York Convention. If there is no agreement, then the arbitrators should agree on a place in line with arbitration rules, excluding any of the countries of the Parties.

The award issued by the arbitration panel will be final and binding for the parties and will be subject to the motions for clarification or annulment provided for in Section 760 of the Argentine National Code of Civil and Commercial Procedure on the terms therein set forth, or to any applicable appeals in force in the jurisdiction of the place of the arbitration, which may in no case result in the review of the assessment of the facts of the case and/or of the application of the applicable law.

8. Environmental Regulation

Resolution 65 provides that permit holders and/or concessionaries must use the best techniques available to prevent and mitigate negative environmental impacts; must make a rational use of natural resources; must implement an Environmental Management System designed according to recognized international models for the activities (including risk evaluation and management); and must comply with all legal and regulatory rules of the Republic of Argentina and international conventions and treaties on the matter subscribed and ratified by the Republic of Argentina.

Regarding environmental liability, Resolution 65 provides that permit holders and/or concessionaries will be liable for the environmental liabilities generated as a result of the oil operations under their responsibility and must assume the costs of any remedial actions required in connection thereto. They must also be in charge of all activities relating to the abandonment of the wells drilled by them. They are obliged to adopt all practices commonly accepted by the international community in connection with these abandonment activities.

9. Closing remarks

The Round has been launched and the process of formulating queries and clarifications to the SE will be open until February 14, 2019. Since the discovery of the productive potential of the Vaca Muerta oil field in 2011, non-conventional resources have captured most of the attention with regard to Argentine oil & gas activity. However, the development of both non-conventional and offshore potential should not be exclusive, but should be supported by their development in a complementary manner.

The development of this international bid implies the arrival of significant investments in the sector and in the development of the hydrocarbon activity in Argentina.

It is well known that non-conventional production requires specific technology and large investments, which carries intrinsic higher risk. One way of diversifying the risk and ensuring the supply of the energy matrix from depending largely on natural gas is to encourage the exploration and development of offshore production.

In addition, and especially after the final approval of the new outer limit of the Argentine Continental Platform by the United Nations between 2016 and 2017 which resulted in the incorporation of one million seven hundred and eighty-two thousand five hundred square kilometers to the continental platform, the Argentine continental platform presents a unique opportunity for those companies interested in the exploitation of offshore resources.

Taking into consideration the solid investments and increase in production of the Vaca Muerta non-conventional blocks, if we add in the investments expected in offshore areas and in wind, solar and other forms of renewable energy, which are expected to supply 20% of the energy matrix by 2025, Argentina should not only be self-sufficient, but should also become an energy-exporting country again in the near future.

Source: Argentine Secretariat of Energy

This insight is a brief comment on legal news in Argentina; it does not purport to be an exhaustive analysis or to provide legal advice.