Application and Determination of Taxes on Bets

On May 2, 2017, Resolution 4036-E/2017 regarding the application and determination of taxes on bets was published in the Official Gazette.

On December 27, 2016, Law No 27,346 (the "Law") was published in the Official Gazette of the Republic of Argentina, through which several changes were made to the Argentine tax regime. In addition, the law introduced two new taxes: (i) a specific tax on bets; and (ii) an indirect tax on online betting.

Even though the Law was enacted in December 2016, until now there was no formal procedure to comply with the determination and payment of the tax on bets. Only a few clarifications had been made with the publication of Decree No.179 on March 15, 2017.

It was not until May 2017 when the Official Gazette published Resolution 4036-E (the "Resolution") issued by the Federal Public Revenue Administration ("AFIP") which essentially regulates the procedure and the operational aspects related to the compliance of the Law.

Principal aspects

According to the policy of the AFIP of applying electronic methods to the procedures by which taxpayers fulfill their obligations, the determination of the tax on bets, as well as the preparation and filing of the respective affidavit, must be made through the online service called "Specific Tax on bets".

The filing of the affidavit will be made every fifteen days and must be made even if there is no tax to be paid. Otherwise, the AFIP could instruct a summary for non-compliance of the formal duties under the terms of Tax Procedure Law 11,683 ("TPL").

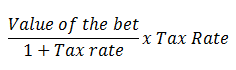

The determination of the tax will be made considering that the value of each bet includes the amount to be paid for tax. The following formula must be applied:

The Resolution entered into force on its publication in the Official Gazette.

This insight is a brief comment on legal news in Argentina; it does not purport to be an exhaustive analysis or to provide legal advice.